Overview

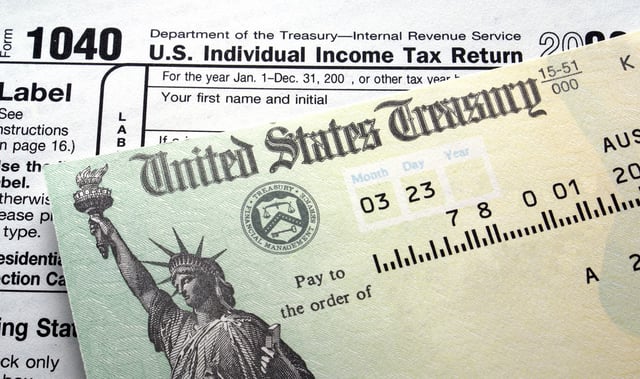

- The IRS began accepting 2024 tax returns on January 27, with over 140 million returns expected by the April 15 deadline.

- Most refunds are issued within 21 days for electronically filed returns, while paper returns or amended filings may take four weeks or longer.

- Refunds claiming Earned Income Tax Credit or Additional Child Tax Credit will not be issued before mid-February, with most expected by March 3.

- Taxpayers can track their refund status via the IRS's 'Where's My Refund?' tool or the IRS2Go mobile app, requiring their Social Security number, filing status, and refund amount.

- Delays may occur due to errors, incomplete information, or additional reviews, and the IRS will notify taxpayers via letter if further action is required.