Overview

- About 34,000 IRS employees were placed in non-pay, non-duty status starting Oct. 8, leaving roughly 39,870 on duty under a contingency plan running through April 30, 2026.

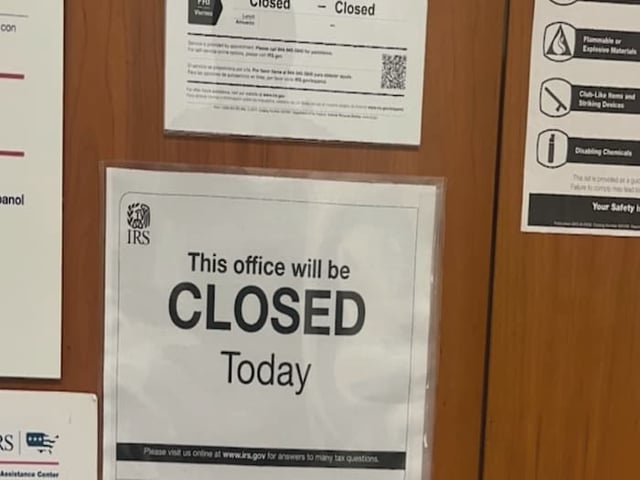

- The plan prioritizes tax processing, IT and data protection, criminal investigations, bankruptcy and lien casework, and disaster-relief support, while call centers and most administrative services are paused.

- An IRS letter told furloughed employees they will receive back pay once the shutdown ends, though a White House memo cast doubt on guaranteed back pay despite a 2019 law requiring compensation after lapses.

- Employees reported confusion and abrupt send-home orders at local offices, and the agency set up an emergency hotline and instructed staff to report for their next shift to receive furlough notices.

- Unions warned of longer waits, growing backlogs and difficulty meeting the Oct. 15 extension deadline for 2024 returns, with the furlough compounding earlier 2025 workforce cuts from about 100,000 to roughly 75,000.