Overview

- Intel is projected to report a roughly $1.25 billion net loss for April–June, marking its sixth straight quarterly loss and a fifth consecutive revenue drop to about $11.9 billion

- Since taking the helm in March, CEO Lip-Bu Tan has launched aggressive cost cuts, headcount reductions and sold a 51% stake in Altera as part of a broader restructuring

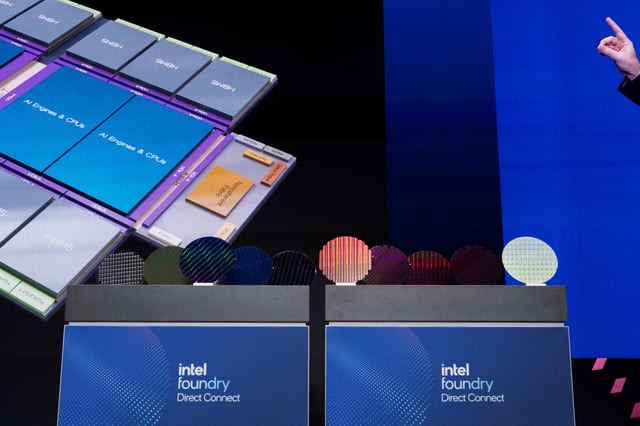

- Tan has shelved the 18A process championed by his predecessor in favor of a next-generation 14A node designed to attract external foundry customers

- Analysts warn potential writedowns on the 14A pivot could reach hundreds of millions of dollars and may influence the timeline for the foundry unit to break even by 2027

- Intel faces intensified competition as TSMC dominates contract manufacturing and rivals Nvidia and AMD gain share in AI accelerators and CPU markets