Overview

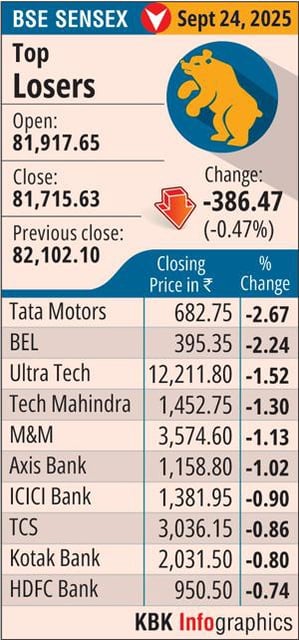

- Shares of key Indian IT firms declined for a third session, with Mastek down 3.42%, Infobeans 3.41%, Wipro 2.06%, Tech Mahindra 1.30%, TCS 0.86% and Infosys 0.24% as the BSE IT index slipped 0.69%.

- The Department of Homeland Security released a draft rule proposing wage‑based selection for H‑1B petitions when requests exceed the 85,000 annual cap, prioritizing higher‑salary offers.

- The administration clarified that the announced $100,000 H‑1B charge is a one‑time payment for new applicants only and does not apply to renewals or current visa holders.

- Research heads at Geojit and Motilal Oswal cited persistent concerns over U.S. visa policy changes as a drag on sentiment alongside broader foreign investor selling.

- Brokerage analysis warns wage‑based selection could curb fresher hiring and pressure startups and Indian IT firms, a risk amplified by Indians holding over 70% of H‑1B visas.