Overview

- ITR-2 and ITR-3 e-filing utilities were activated in mid-July, adding to the platforms already available for simpler returns.

- The AIS feedback mechanism launched July 16 enables taxpayers to flag incorrect or missing transactions and track whether corrections are accepted or rejected.

- As of July 22, over 1.62 crore returns have been filed and 1.13 crore processed, indicating that more than 80% of taxpayers still need to submit their returns.

- Data mismatches between the Annual Information Statement, Form 26AS or undeclared foreign income now trigger a majority of tax notices, underscoring the need for accurate reporting.

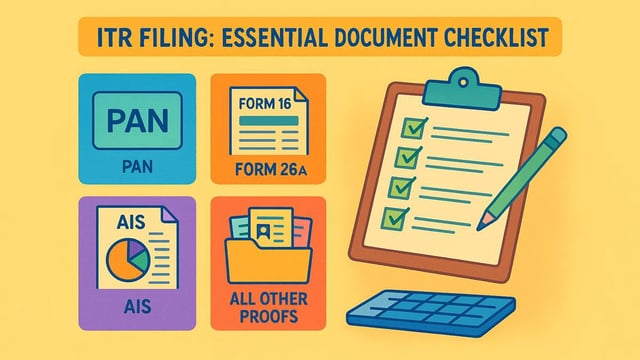

- Taxpayers must link PAN with Aadhaar under Section 139AA and prepare comprehensive documents such as Form 16, investment proofs and foreign asset disclosures to avoid delays.