Overview

- Petrol cars under 909 kg, 1,200 cc and 4,000 mm get a 3 g CO2/km deduction in fleet accounting, capped at 9 g/km per model.

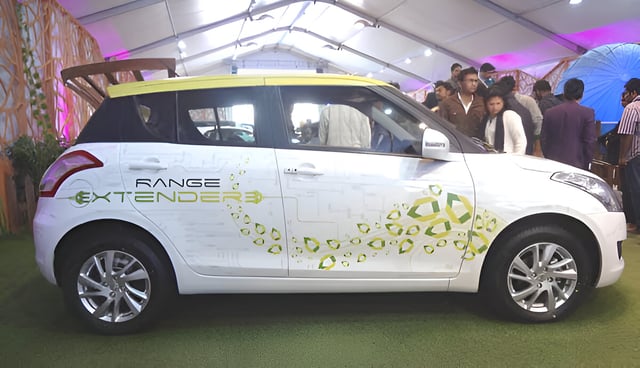

- New super-credits weight cleaner technologies more heavily in averages, with BEVs and range-extender EVs counted as 3, plug-in or flex-fuel strong hybrids as 2.5, strong hybrids as 2, and flex-fuel ethanol cars as 1.5.

- A carbon neutrality factor reduces reported tailpipe CO2 for alternative fuels, including an 8% discount for E20–E30 petrol blends and up to 22.3% for flex-fuel hybrids, with CNG also discounted based on biogas blending.

- Compliance flexibilities include pooling of up to three manufacturers and an exemption for makers selling fewer than 1,000 vehicles annually.

- The proposal phases fleet fuel-consumption limits from about 3.726 L/100 km in FY28 to about 3.014 L/100 km in FY32 and drops hydrogen from the super-credit list compared with the June 2024 proposal.