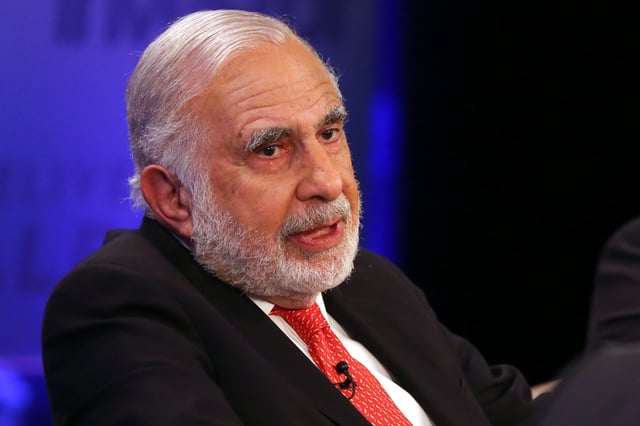

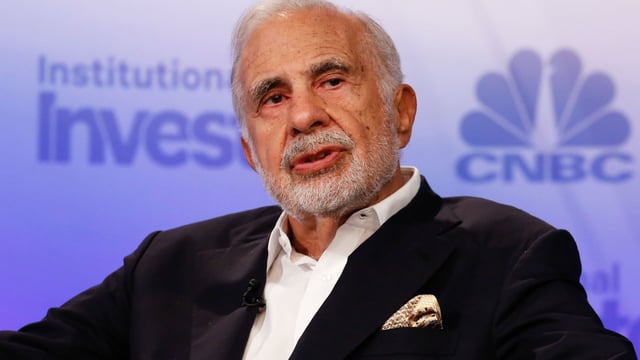

Overview

- Icahn Enterprises reported an unexpected quarterly loss due to market volatility and a inquiry by federal prosecutors regarding corporate governance and capitalization.

- The Southern District of New York's attorney's office contacted Icahn Enterprises for information following a short seller's report accusing the company of inflating asset values.

- Icahn Enterprises' stock dropped nearly 40% since May 2 when Hindenburg Research published a report alleging the company overvalued holdings and paid "Ponzi-like" dividends.

- The holding company, which invests in energy, automotive, food packaging, metals and real estate, denied Hindenburg's accusations in a letter emphasizing their strategy and resources.

- Icahn Enterprises stated the federal inquiry would not significantly impact their business but continues to cooperate by providing requested documents.