Overview

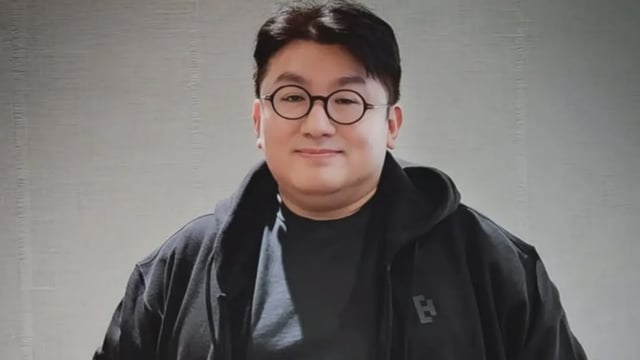

- The Securities and Futures Commission unanimously recommended on July 9 that Bang Si-Hyuk be referred and will vote to formalize the move on July 16

- Investigators allege Bang struck secret pre-IPO deals to share 30% of stock-sale profits with a private equity fund, netting him roughly 400 billion won after the 2020 listing

- Regulators suspect these hidden agreements allowed Bang to bypass mandatory lock-up restrictions for major shareholders

- Hybe has apologized for public concern, asserts its IPO complied with regulations, and pledges full cooperation with financial and police investigations

- A separate Seoul Metropolitan Police Agency inquiry continues, with two rejected search warrant requests underscoring investigative hurdles