Overview

- The proposal offers HK$155 in cash for the 36.5% of Hang Seng shares HSBC does not own, valuing that purchase at about HK$106.1 billion (approximately US$13.6 billion) at a roughly 30% premium to the last close.

- HSBC says the price is final, with Hang Seng’s publicly listed shares to be canceled under a Hong Kong scheme of arrangement if the deal proceeds.

- The transaction requires a recommendation from Hang Seng’s board followed by shareholder, court, and regulatory approvals under Hong Kong law.

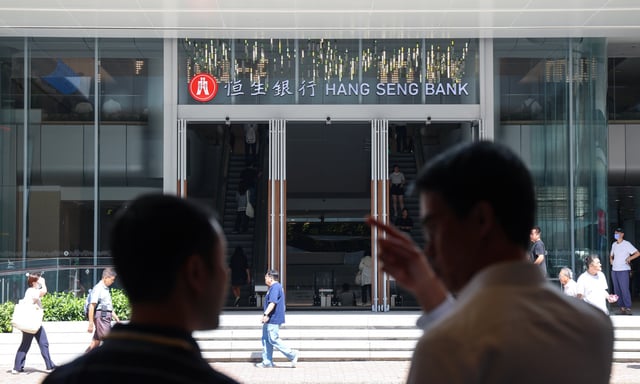

- HSBC currently owns about 63% of Hang Seng and says it intends to retain the Hang Seng brand and branch network if the deal completes.

- The offer follows rising impaired loans at Hang Seng tied to property exposure, with the ratio up to 6.1% of gross loans at end‑2024 from 2.8% a year earlier.