Overview

- HSBC said a hybrid quantum–classical model delivered up to a 34% improvement in estimating whether a quoted bond trade would be filled in Europe’s over-the-counter market.

- The experiment analyzed more than 1 million quote requests across roughly 5,000 corporate bonds from September 2023 to October 2024.

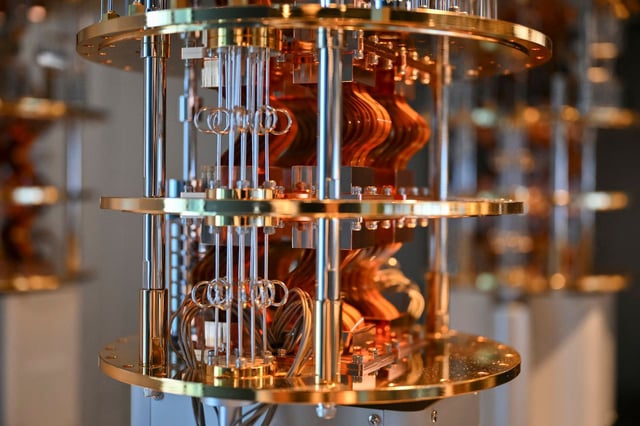

- The workflow incorporated IBM’s Heron processors in a quantum-classical pipeline, with most methods kept proprietary and no live trades executed.

- IBM shares rose about 5% after the announcement as investors weighed a potential near-term use case for quantum computing.

- Independent experts questioned whether the reported gains reflect true quantum advantage rather than hardware noise or methodology, and HSBC cautioned the results may not generalize to other markets or datasets.