Overview

- The proposed 5% excise tax on remittances by non-U.S. citizens aims to fund tax relief extensions and border security projects, with a potential implementation date of July 4, 2025.

- The tax would affect over 40 million immigrants, including green card holders and visa holders, while exempting U.S. citizens and nationals.

- Foreign leaders, including Mexico's President Claudia Sheinbaum, have condemned the measure as unjust and warned of double taxation and economic harm to recipient countries.

- Experts caution the tax could reduce remittance flows, destabilize vulnerable economies, and incentivize informal transfer methods, complicating financial oversight.

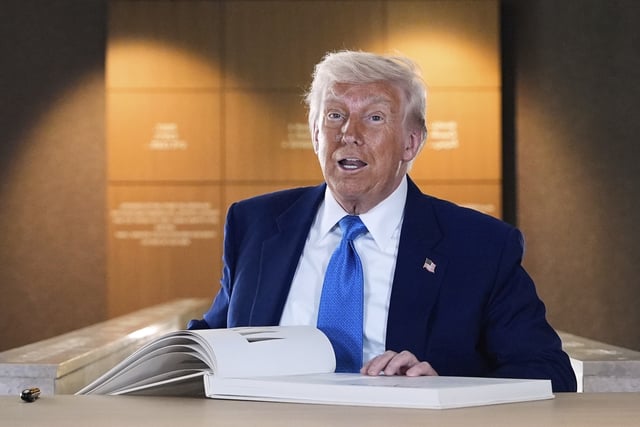

- The bill, part of President Trump's broader tax and border security agenda, has passed committee review and faces a full House vote by May 26, with Senate deliberations to follow.