Overview

- The Hong Kong Monetary Authority opened a window on August 1 for a limited batch of stablecoin license applications, prioritizing business-to-business issuers with rigorous capital and AML criteria.

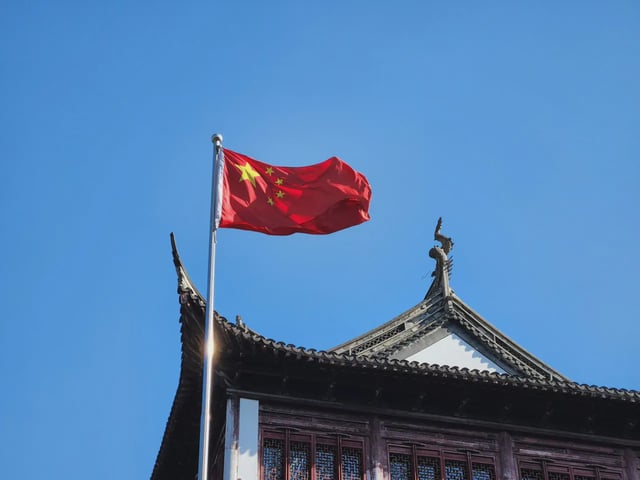

- Only one of China’s four major state-owned banks is expected to secure a stablecoin license in Hong Kong’s initial phase, with first approvals slated for early 2026.

- People’s Bank of China governor Pan Gongsheng has signaled support for a yuan-pegged stablecoin aimed at advancing renminbi internationalization and reducing reliance on the U.S. dollar.

- Chinese regulators have instructed brokerages and think tanks to halt stablecoin promotion over fraud and capital outflow concerns, reflecting a tightened stance on digital-asset marketing.

- Authorities in Hong Kong and mainland China stress alignment with national conditions, enforcing strict reserve, AML and fraud controls to integrate fiat-pegged tokens into mainstream finance.