Overview

- Home Depot reported U.S. comparable sales up about 1.4% in Q2, while Lowe’s posted a 1.1% gain, with growth leaning on bigger tickets rather than more transactions.

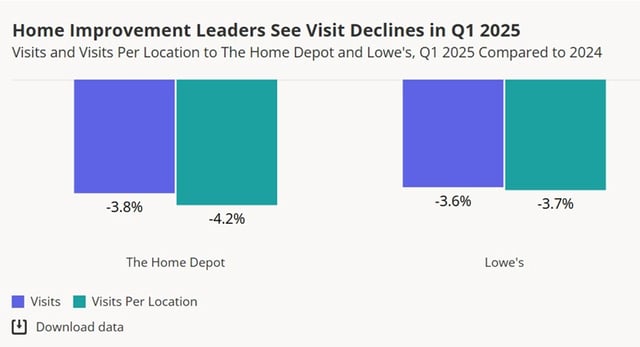

- Placer.ai data show year-over-year foot traffic fell 3.8% at Lowe’s and 2.2% at Home Depot in the quarter, with a brief March bump linked to storm preparation.

- Executives from both chains said customers are deferring larger, financed projects, citing a weak housing market and mortgage rates still above 6%.

- Home Depot flagged tariff-driven cost pressure and said prices will move modestly in select categories, emphasizing focus on maintaining project-level value.

- Lowe’s said about 60% of its goods are sourced in the U.S. and described real-time dynamic pricing to manage tariffs, as coverage also noted a reported August boycott tied to softer visits.