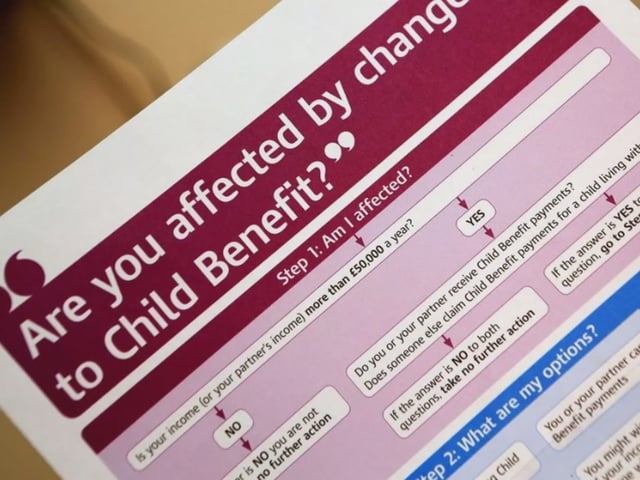

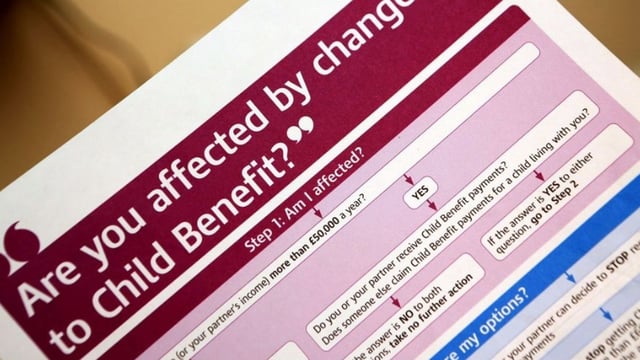

Overview

- The new PAYE route took effect this week, allowing higher earners to settle the charge via their tax code instead of filing a self-assessment solely for this purpose.

- HMRC will contact more than 100,000 people newly liable for the charge to invite them to use the online service, with an opt-in deadline of 31 January 2026 for the 2024/25 tax year.

- Access is limited to those in employment who do not otherwise need to file a return, while the self-employed and people with £10,000 or more in untaxed investment income must continue using self-assessment.

- Once opted in, HMRC adjusts the individual’s tax code and the charge is deducted as additional income tax through PAYE, and those who previously filed only for this charge can call HMRC to switch.

- Experts advise parents to register for Child Benefit even if they opt out of payments to secure National Insurance credits and automatic National Insurance numbers for children, with broader backdating of NI credits reported to begin in April 2026.