Overview

- The PAYE collection service is now live, allowing employed parents to opt in so HMRC deducts the charge via an adjusted tax code that updates in-year for income or entitlement changes.

- HMRC says it will contact more than 100,000 people newly liable for the charge to invite them to use the online service.

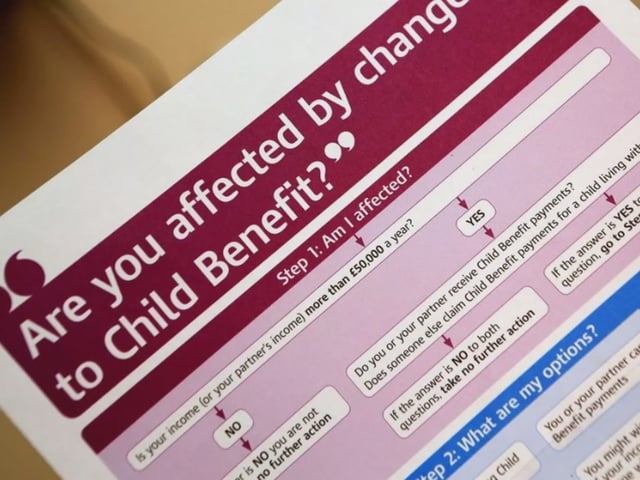

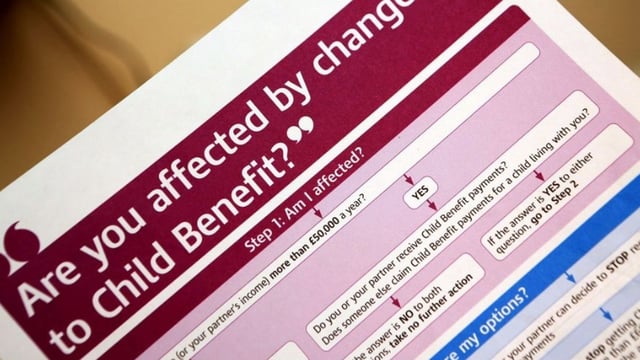

- The charge tapers in once an individual’s income exceeds £60,000 and claws back Child Benefit in full at £80,000 under rules in place since April 2024.

- Parents who must file Self Assessment for other reasons, such as self-employment or significant untaxed income, must continue to pay the charge through their tax return.

- Families are encouraged to claim Child Benefit or opt out of payments to retain National Insurance credits and automatic NI numbers for children, with backdated credits reported as claimable from April 2026.