Overview

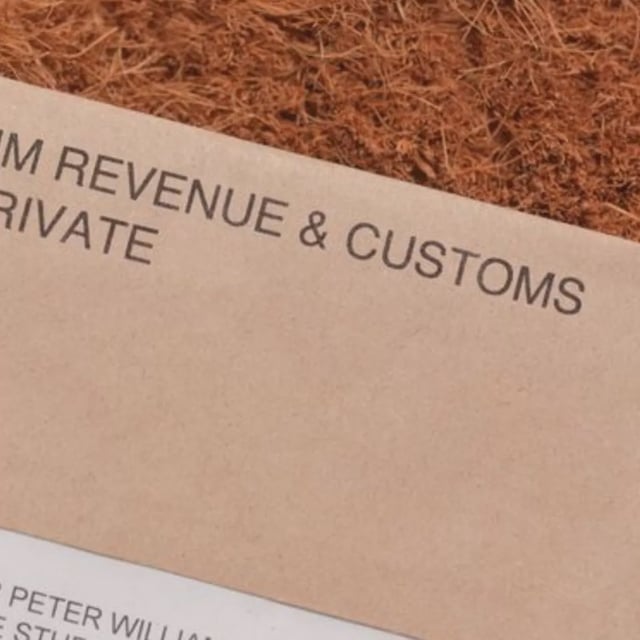

- State pensioners are receiving brown envelopes from HMRC containing refunds averaging £3,000, following widespread overtaxation of pension withdrawals.

- Over 15,000 individuals reclaimed a total of £44 million between January and March 2025, with refunds averaging £2,881 per person.

- New rules introduced in April 2025 automate tax code adjustments for regular pension withdrawals, expediting accurate taxation for recurring payments.

- One-off pension lump sums remain taxed at emergency rates, often at 40%, requiring pensioners to manually reclaim overpaid taxes using HMRC forms P55, P53Z, or P50Z.

- Since flexible pension access began, over £1.4 billion in overpaid taxes has been refunded, though experts warn many eligible individuals have yet to claim their refunds.