Overview

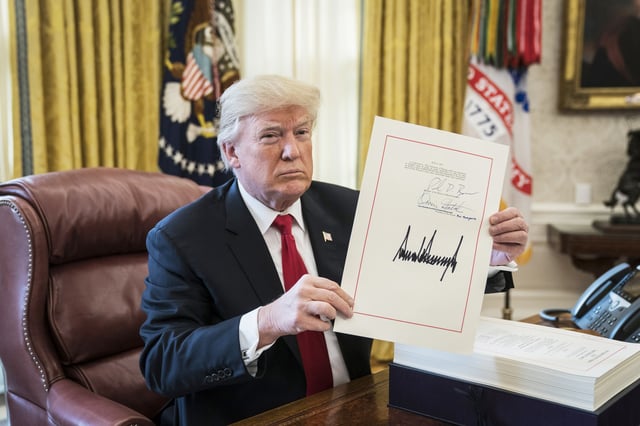

- Republicans seek to extend individual tax cuts from 2017 set to expire in 2025.

- Proposals include reducing the corporate tax rate below the current 21%, potentially to 15%.

- Analysts estimate a significant increase in the national debt if these cuts are implemented.

- The Biden administration criticizes the plans as favoring wealthy corporations over middle-class Americans.

- Debate intensifies as the GOP prepares for potential control of Congress and the White House in upcoming elections.