Overview

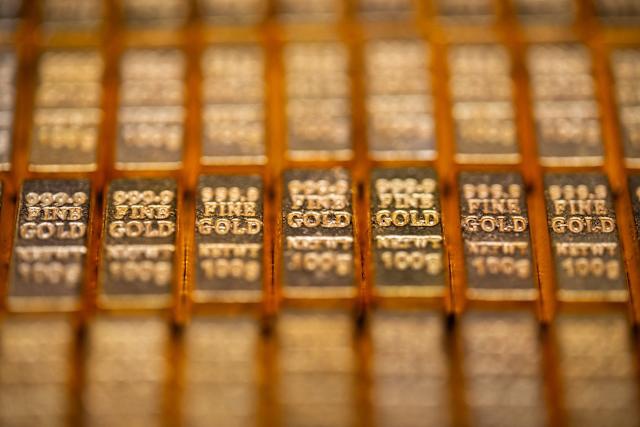

- Gold is trading at approximately $3,024 per ounce, reflecting a 15% increase in 2025 to date.

- Bank of America raised its gold price forecasts to $3,063 per ounce for 2025 and $3,350 for 2026, citing U.S. trade policy uncertainty and strong central bank demand.

- Goldman Sachs increased its end-2025 forecast to $3,300 per ounce, with a potential range of $3,250 to $3,520, supported by ETF inflows and sustained buying by Asian central banks.

- Analysts highlight potential upside risks, including a recession-driven Federal Reserve rate-cutting cycle and increased investor demand for gold as a hedge.

- Key risks to the rally include geopolitical de-escalation, U.S. fiscal consolidation, and potential short-term price impacts from events like a Russia-Ukraine peace agreement or equity market volatility.