Overview

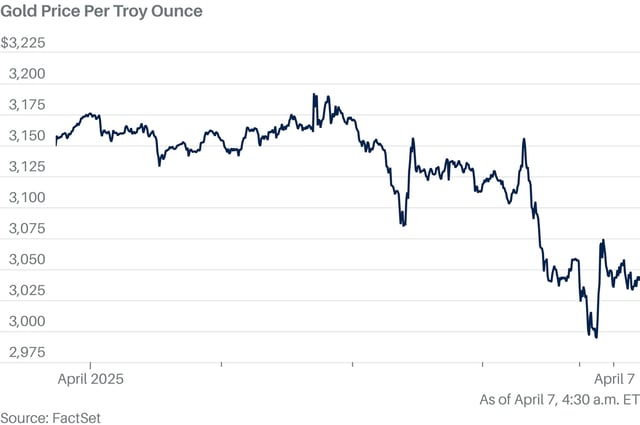

- Gold prices rose 0.1% to $3,040.57 per ounce on Monday, rebounding from a session low of $2,971.09 as investors sought stability in volatile markets.

- President Donald Trump's new tariffs and China's retaliatory measures, including 34% levies on U.S. goods, have intensified global recession fears.

- Broader financial markets are under pressure, with the S&P 500 nearing a bear market and Japan's Nikkei index dropping 9% on Monday.

- Declines in other commodities, such as a 3% drop in oil prices and a 6% drop in copper prices, highlight the widespread economic impact of trade tensions.

- Analysts predict continued support for gold prices due to rising recession risks, a weaker U.S. dollar, and expectations of Federal Reserve rate cuts.