Overview

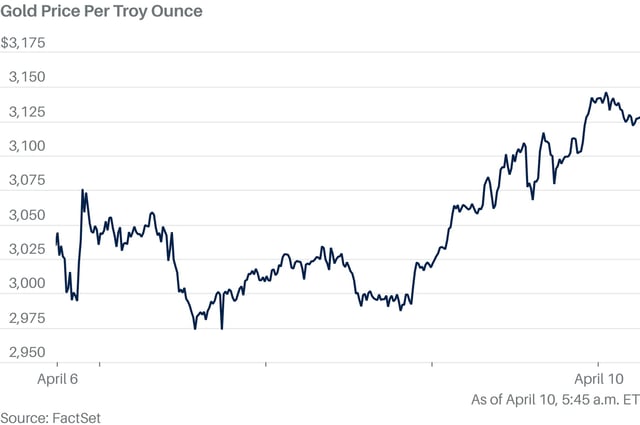

- Gold surged past US$3,200 per ounce, reaching a record high of US$3,219.84 on April 11, 2025, as investors seek safe-haven assets.

- Mounting recession fears, a weakening US dollar, and rising bond yields have bolstered gold's appeal as a crisis hedge.

- US-China trade tensions, exacerbated by President Trump's increased tariffs, have heightened market volatility, further driving gold demand.

- Expectations for additional Federal Reserve interest rate cuts and increased central bank gold purchases are fueling the rally.

- Analysts forecast gold prices could climb to around US$3,500 per ounce later this year, reflecting sustained investor confidence in the asset.