Overview

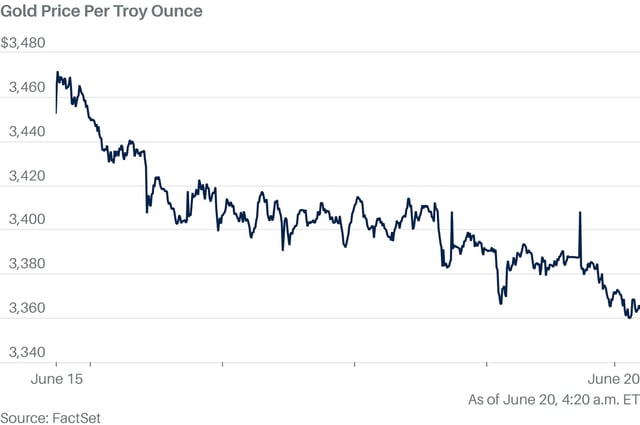

- Spot gold traded near $3,369 an ounce this week and is set for a roughly 2% decline, marking its first weekly drop in three.

- The Federal Reserve maintained its benchmark rate and signaled that elevated inflation could delay its two projected rate cuts for the year.

- President Donald Trump postponed a decision on U.S. involvement in Israel’s conflict with Iran, easing market fears of a wider Middle East war.

- Investors are rotating into silver and platinum as gold’s strong year-to-date surge pushes prices close to record highs.

- Analysts’ forecasts diverge sharply, with Goldman Sachs eyeing $4,000 an ounce next year and Citigroup projecting a fall below $3,000 by 2026.