Overview

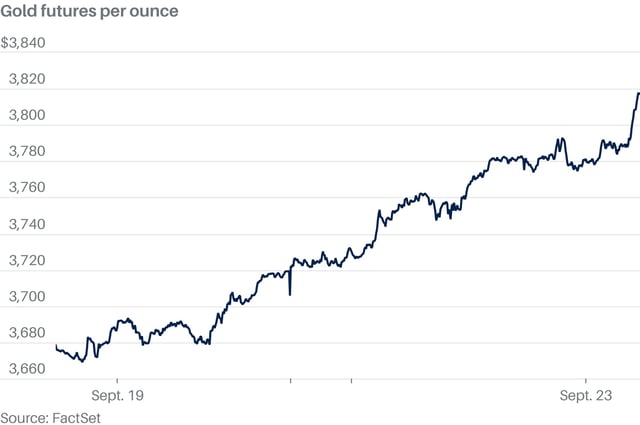

- Spot gold printed a new high above $3,790 on Tuesday before easing to roughly $3,760 in Asian trade Wednesday as some investors booked profits following Powell’s cautious tone.

- Futures pricing points to a high probability of another 25-basis-point Fed cut in October and solid odds of a further reduction in December, reinforcing support for bullion.

- Holdings in the SPDR Gold Trust rose to 1,000.57 tons from 994.56 tons across Friday to Monday, indicating renewed ETF inflows.

- Reports citing Bloomberg said the People’s Bank of China has encouraged other central banks to buy via the Shanghai Gold Exchange with custody in China, a factor linked to fresh price strength.

- Bitcoin trades near $112,000 after a roughly 3% drop earlier this week, with some market commentary noting gold’s advance began about an hour after BTC’s decline.