Overview

- The world’s 65 largest banks boosted financing for oil, gas and coal projects to $869 billion in 2024, a $162 billion increase over the prior year.

- President Trump’s executive orders have driven the U.S. to withdraw from the Paris Agreement in early 2026 and exit global climate finance coalitions, prompting banks to ditch green pledges.

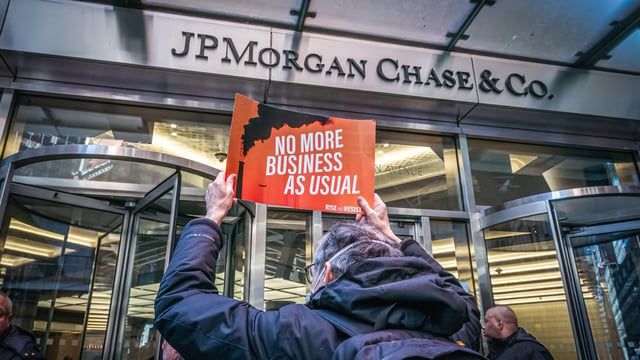

- U.S. banks dominate fossil fuel lending, with JPMorgan Chase at the top providing $53.5 billion and four of the five largest financiers based in the United States.

- Since the Paris Agreement came into force in 2016, these banks have committed $7.9 trillion to fossil fuel financing, entrenching long‐term carbon dependence.

- Expanded funding has exacerbated environmental and social harms, from pollution and health risks in U.S. communities to forced relocations in Mozambique