Overview

- The Grundsteuerreform, effective January 1, 2025, has introduced new valuation rules for property taxes, leading to significant changes in tax bills for owners across Germany.

- Many property owners are experiencing sharp increases in their tax obligations, with some cases reporting hikes as high as 19 times the previous amount.

- Homeowners' associations and advocacy groups, such as Haus & Grund, have announced legal challenges to address perceived inequities in the reform's implementation.

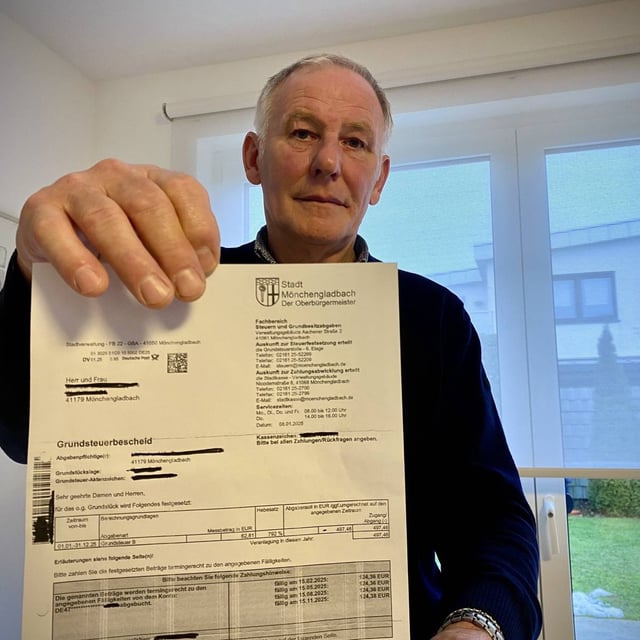

- Municipalities, including Düsseldorf and Mönchengladbach, report growing frustration and confusion among residents over the new tax assessments and limited options for appeal.

- The reform aimed to be revenue-neutral for municipalities, but its impact varies widely, with urban areas and high-value properties often facing higher taxes compared to rural or less-developed regions.