Overview

- A 3.74% statutory pension increase will take effect on July 1, 2025, benefiting approximately 21 million retirees.

- The taxable portion of pensions rises to 83.5% in 2025, potentially pushing an estimated 73,000 retirees into tax liability for the first time.

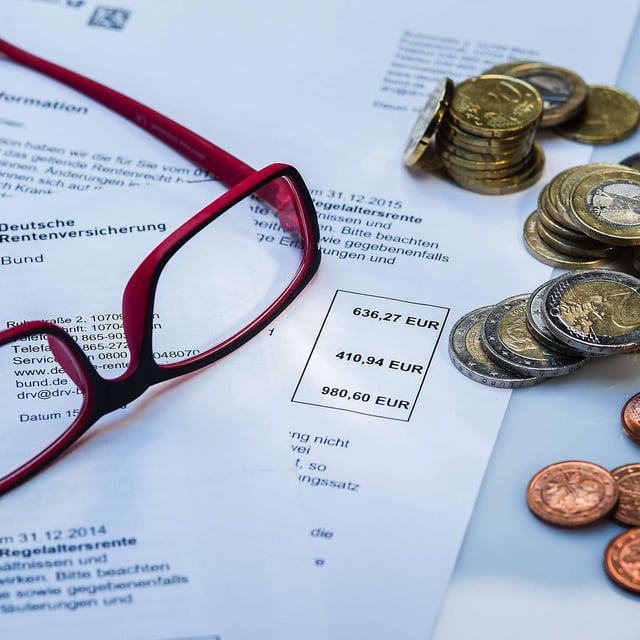

- Retirees are advised to audit their Deutsche Rentenversicherung (DRV) insurance accounts for missing contribution periods, which can significantly impact pension amounts.

- The DRV offers account reconciliation services, requiring documentation such as employment contracts and proof of child-rearing periods to address discrepancies.

- Pension payout schedules vary: applications filed before April 2004 receive payments at the start of the month, while later filings are paid at the month’s end.