Overview

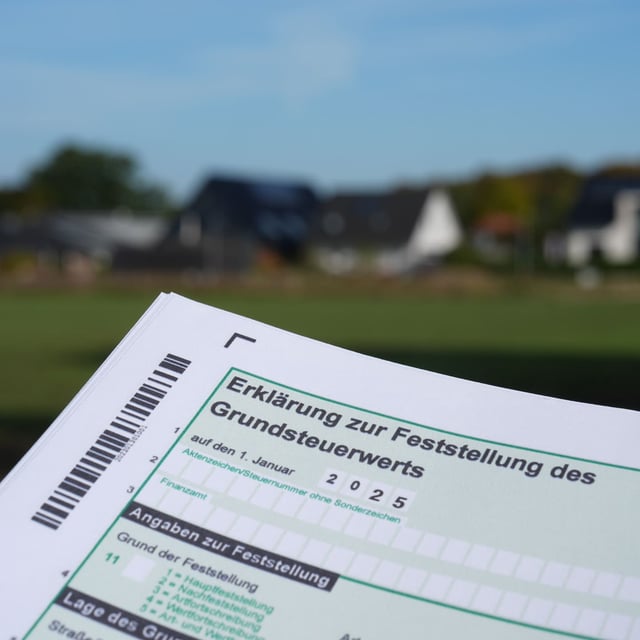

- The 2025 Grundsteuerreform, mandated by the Federal Constitutional Court, introduced new property valuation methods to replace outdated systems from 1964.

- Municipalities across Germany, including Dresden, Wermsdorf, and Frankenthal, report significant administrative challenges and a surge in appeals over tax discrepancies.

- While the reform aimed for 'revenue neutrality,' some property owners face sharp tax increases, with cases like Mügeln seeing up to sixfold hikes in Grundsteuer B for certain properties.

- Cities like Dresden have already corrected numerous tax assessments downward due to successful appeals, raising questions about initial calculation accuracy.

- Local governments are grappling with financial uncertainties, as varying property valuations and unresolved appeals complicate revenue projections.