Overview

- The French government is considering removing the 10% tax deduction for retirees, a measure that could save nearly €5 billion annually for the 2026 budget.

- The deduction, introduced in 1978, benefits around 15 million retirement households and was designed to align retirees' tax treatment with that of active workers.

- Unions and opposition parties warn that eliminating the deduction would increase taxes for 8.4 million retirees and make 500,000 currently non-taxable households liable for taxes.

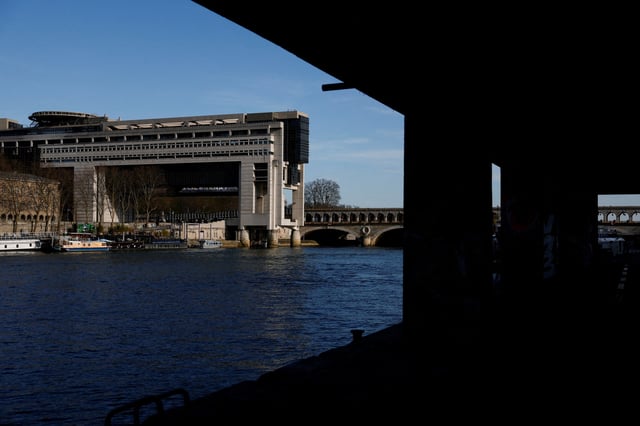

- The Public Accounts Ministry supports the measure as necessary for deficit reduction, while the Economy Minister opposes broad tax hikes, reflecting internal governmental divisions.

- Business leaders, including the heads of the Conseil d’orientation des retraites (COR) and Medef, back the proposal, calling the deduction outdated and misaligned with current fiscal priorities.