Overview

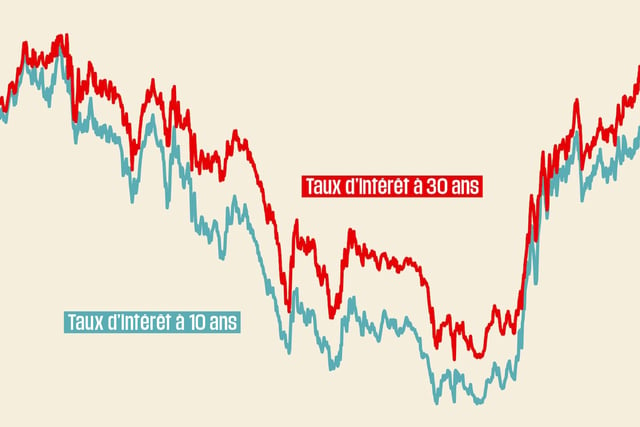

- Agence France Trésor placed long-dated OATs on September 4 with the 10‑year at 3.57% versus a 3.5% target, the 2042 at 4.04%, and the 2056 at 4.43%, a post‑2008 high for 31‑year debt.

- Investor orders totaled about €25 billion for €11 billion offered, indicating solid demand despite higher rates.

- The state faces a record roughly €300 billion 2025 funding program on a debt stock around €3.3–€3.345 trillion, about 114% of GDP.

- Rising rates are set to lift interest costs from €53 billion in 2025 to an estimated €66 billion in 2026, according to official projections.

- Political uncertainty around a likely Bayrou government collapse has had limited impact so far, but a possible Fitch downgrade on September 12 could push funding costs higher.