Overview

- Radio France reports that the Finance Ministry has opened tax procedures targeting 13 lenders over dividend-arbitrage operations.

- Bercy declined to comment, after Economy Minister Éric Lombard in July cited reassessment actions against five institutions totaling €4.5 billion.

- Crédit Agricole’s investment arm agreed in early September to pay €88.24 million in a judicial settlement, the first resolution in the French case.

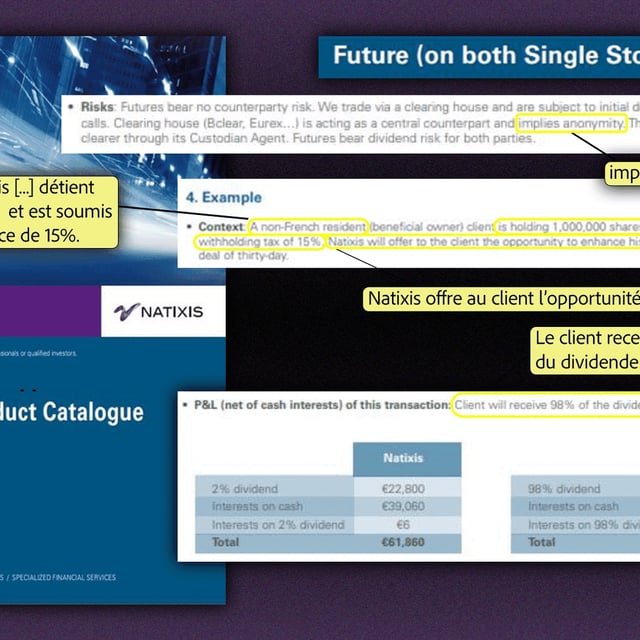

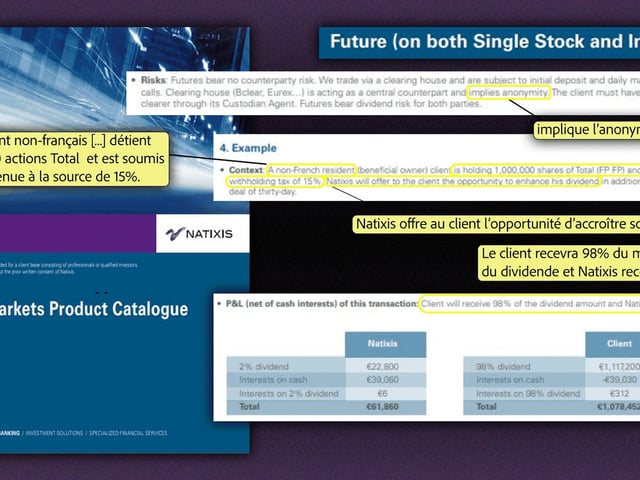

- Five firms—including BNP Paribas, Exane, Société Générale, Natixis, and HSBC—were searched in March 2023 as part of the national financial prosecutor’s investigation.

- The CumCum practice involves temporarily transferring shares around dividend dates so non‑resident investors avoid withholding tax while banks collect fees, a practice the French Banking Federation says does not reflect systemic fraud.