Overview

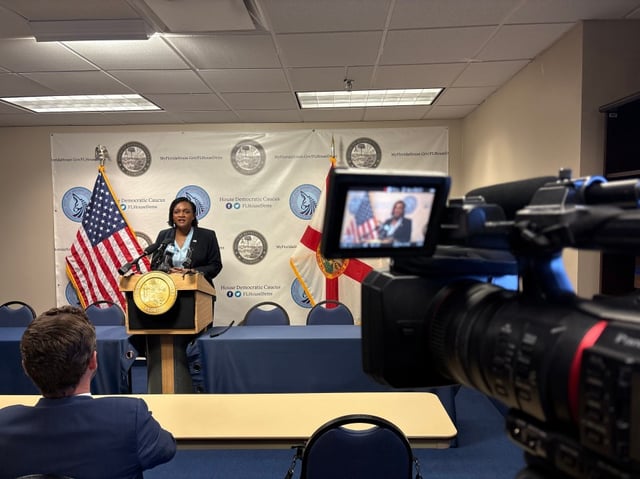

- Senate Democrats unveiled a coordinated six-bill Affordability Agenda focused on property insurance, calling for bipartisan support ahead of the Jan. 13, 2026 session.

- A key bill by Sen. Barbara Sharief would cap annual property insurance rate increases between 10% and 15% and grant the Insurance Consumer Advocate hearing and subpoena powers on pricing.

- Other measures would make permanent the sales-tax break for impact-resistant upgrades, require mediation before some homeowner lawsuits, protect against nonrenewals based on roof age, and expand whistleblower safeguards.

- Republican leaders, including Gov. Ron DeSantis and House Speaker Danny Perez, are advancing a separate property-tax redesign through a House select committee with the goal of placing at least one constitutional amendment on the November 2026 ballot.

- Lawmakers frame insurance costs—reported around $3,800 a year on average—as a primary pressure on homeowners, while Democrats warn broad tax changes could strain school and local-service funding.