Overview

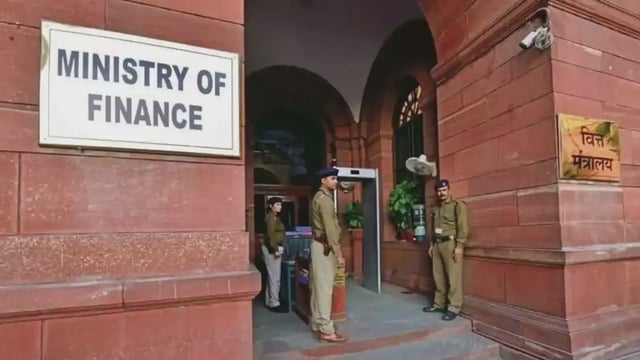

- Department of Financial Services recommended excluding loans up to Rs 2 lakh from RBI’s draft gold loan guidelines to protect small-ticket borrowers.

- The Finance Ministry also advised delaying the norms’ enforcement until January 1, 2026 to allow lenders time for field-level readiness.

- RBI’s April 9 draft seeks to harmonize gold loan regulation with a uniform 75% loan-to-value cap, mandatory assaying and stricter ownership verification.

- Tamil Nadu CM M.K. Stalin cautioned that tighter underwriting could restrict credit access for farmers and low-income households.

- Outstanding gold loans climbed 76.9% year-on-year to Rs 1.78 lakh crore by January 2025, underscoring the need to balance risk controls with credit inclusion.