Overview

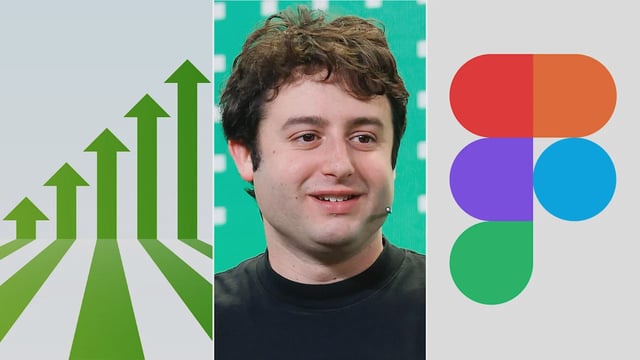

- Figma’s IPO was priced at $33 per share, raising $1.2 billion from the sale of company and investor shares.

- The offering values Figma at approximately $19.3 billion, approaching the $20 billion that Adobe had agreed to pay before regulators halted that deal.

- Figma is set to begin trading on the New York Stock Exchange under the ticker symbol FIG on Thursday.

- Strong financial results underpin investor demand, with Q1 revenue up 46% year-over-year to $228.2 million and net income tripling, and Q2 revenue projected to rise about 40%.

- The IPO was led by Morgan Stanley, Goldman Sachs, Allen & Company and J.P. Morgan, with early backers including Sequoia Capital and Greylock selling shares in the offering.