Overview

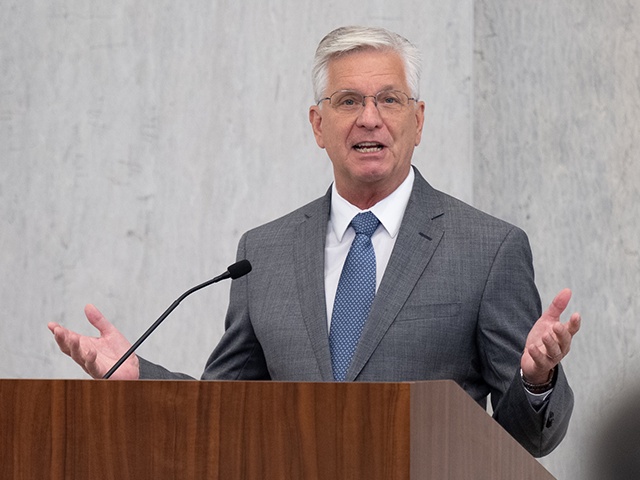

- Waller said he would support ‘good news’ rate cuts later in 2025 if the effective tariff rate hovers near his 10% scenario and core inflation continues toward the Fed’s 2% goal.

- He warned that U.S. tariffs are likely to cause a one-time rise in prices and an uptick in unemployment before fading as inflation expectations remain anchored.

- The Federal Reserve has kept its benchmark rate at 4.25%–4.5% for a third straight meeting while monitoring trade-policy developments.

- Minutes from the Fed’s May meeting showed broad support among officials to await clearer data on tariff impacts before making further monetary adjustments.

- Globally, South Korea saw exports fall 1.3% in May and its central bank trimmed rates by a quarter point to counteract fallout from U.S. tariffs.