Overview

- Less than 40% of the 42.7 million federal student loan borrowers are current on payments and roughly 30% were at least 90 days behind as of May, according to TransUnion

- Older borrowers are under mounting strain, with 18% of those over 50 seriously delinquent in the second quarter, and minority, non-degree holders and low-income borrowers also facing elevated default risks

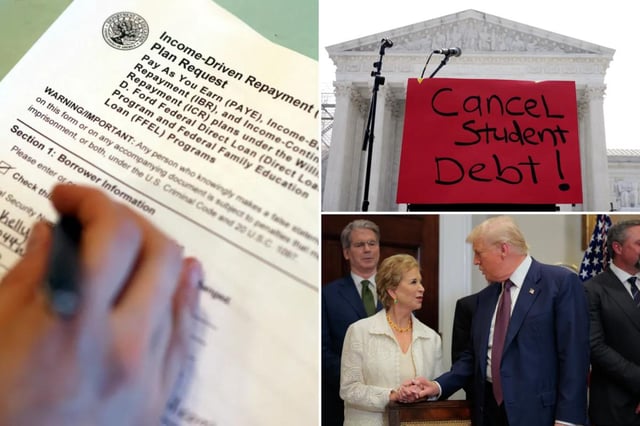

- Active collections resumed on May 5, triggering wage garnishments of up to 15% of after-tax pay and Treasury offsets of tax refunds and federal benefits, initially targeting pre-pandemic defaulters

- Some borrowers are deliberately skipping payments in protest of failed forgiveness efforts while gig and freelance workers often evade garnishment because collectors cannot locate a formal employer

- Income-driven repayment plans, loan rehabilitation, deferments and forbearances remain available but complex servicer processes and short-term credit impacts limit their effectiveness for many borrowers