Overview

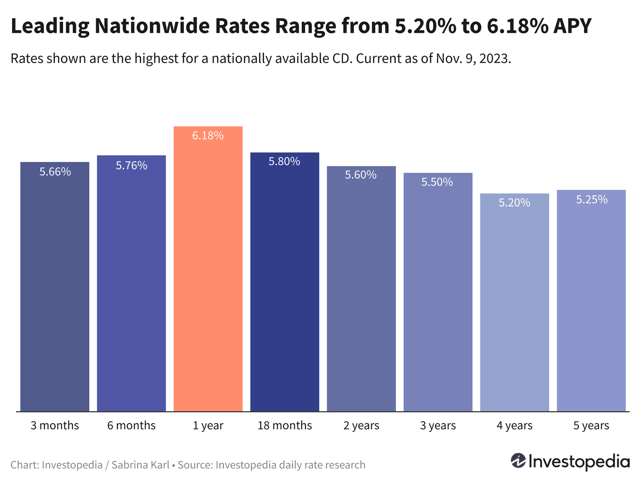

- Top CD rates have reduced recently, with Bayer Heritage Federal Credit Union now offering the best nationwide rate of 6.18% APY for 1-year certificates.

- While the Federal Reserve's aggressive inflation-combat strategy has resulted in record CD rates, it remains unclear if further rate increases are forthcoming.

- CDs, unlike high-yield savings accounts, offer fixed interest rates for the entire term, making them a secure option for earning during fluctuating rate environments.

- With the current high CD rates, an investment of $10,000 can yield from hundreds to thousands of dollars, depending on the length of the term.

- For individuals willing to invest long-term, 10-year CDs provide stability and predictability, act as a hedge against inflation, and help with diversification in a balanced portfolio.