Overview

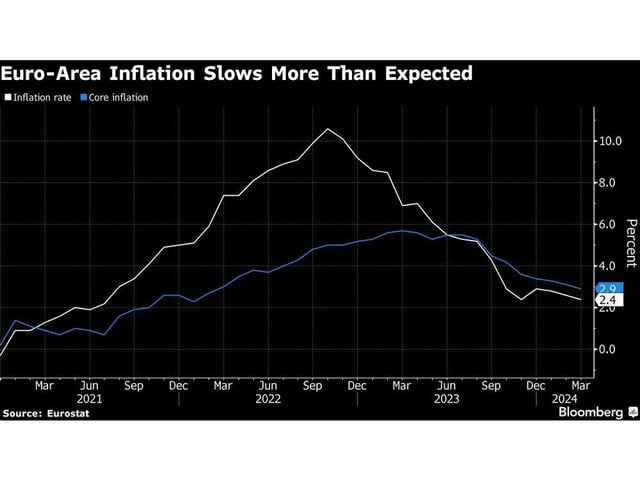

- Federal Reserve officials expect further confirmation that inflation has not decreased as anticipated, suggesting a longer period of high interest rates.

- The core personal consumption expenditures price index, a key inflation gauge, likely remained elevated in March, with a slight acceleration noted.

- Healthy job growth is projected to support continued increases in personal spending and income.

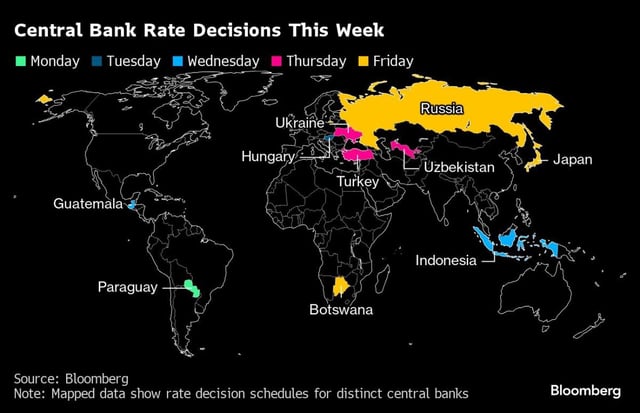

- Global economic indicators, including initial GDP estimates and various central bank decisions, will provide further context to the Fed's cautious approach.

- Mexico's central bank may pause rate cuts, reflecting a broader trend of cautious monetary policy adjustments amid uncertain inflation trends.