Overview

- The Federal Reserve maintained the federal funds rate at 4.25%-4.5% during its May 7 meeting, continuing its pause since December 2024.

- Chair Jerome Powell highlighted the Fed's commitment to managing inflation expectations and avoiding persistent inflationary pressures.

- Economic uncertainty persists due to elevated inflation, low unemployment, and evolving trade, fiscal, and regulatory policies under the current administration.

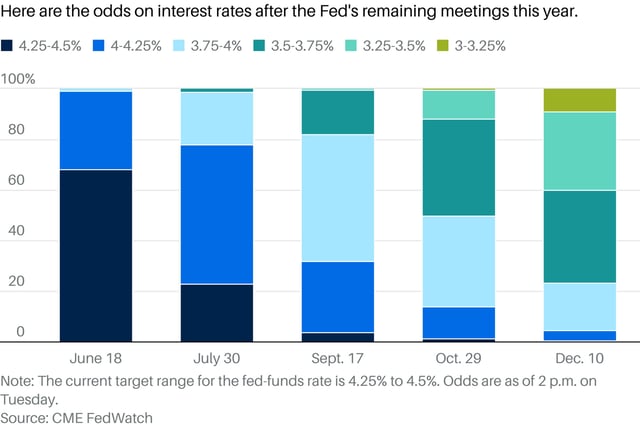

- Markets anticipate potential rate cuts later this year, but Powell stressed decisions will depend on incoming economic data, including inflation and employment trends.

- President Trump has publicly pressured the Fed to lower rates, but Powell reaffirmed the central bank's independence and focus on long-term price stability.