Overview

- Congress shortened the Inflation Reduction Act’s Clean Vehicle Credit, ending up to $7,500 for new EVs and $4,000 for used models after Sept. 30 under legislation signed by President Donald Trump in July.

- Dealers report a late-September buying surge with record August sales, and buyers can still qualify by executing a binding purchase agreement and making a payment by the deadline or by transferring the credit at the point of sale.

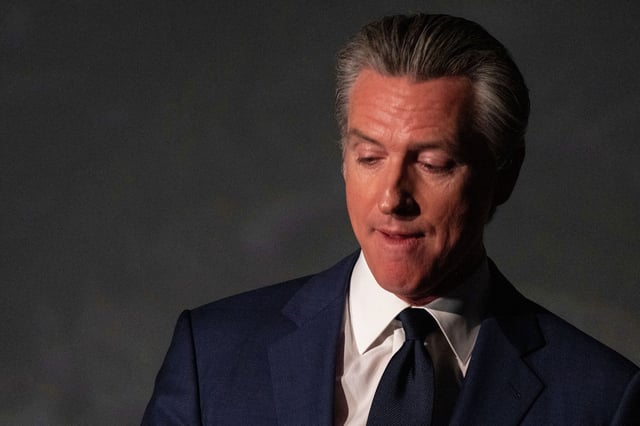

- Governor Gavin Newsom reversed a prior pledge to revive state rebates, saying the state cannot replace the federal subsidy and will prioritize charger buildout funded through cap-and-trade revenues.

- California previously ended its Clean Vehicle Rebate Project in 2023 after issuing about $1.49 billion for nearly 600,000 vehicles, and industry groups had urged the state to create a new incentive as the federal program expires.

- Analysts expect EV demand to soften after the credit lapses, with automakers likely to adjust pricing, production, and incentives to sustain sales.