Overview

- The Federal Reserve announced its fifth consecutive rate hold, keeping the federal funds rate at 5.25% since July 2023.

- Inflation, although reduced from a 40-year high, remains above the Fed's 2% target, influencing mortgage rates.

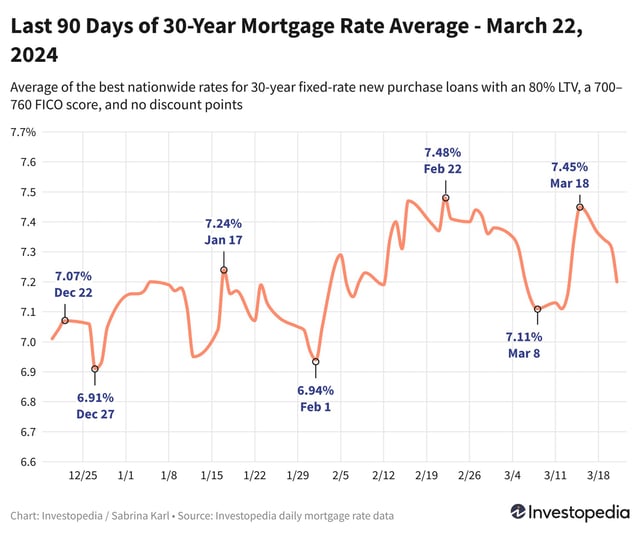

- Mortgage rates have dropped more than a percentage point since peaking in October, with further declines expected.

- The Fed's dot plot forecasts three rate decreases by the end of 2024, potentially easing mortgage rates further.

- Housing market shows signs of optimism, with increases in new home construction and sales despite higher rates.