Overview

- The Fed’s benchmark interest rate remained at 4.25%–4.5% for a third consecutive meeting as officials weigh uncertainty from trade policies.

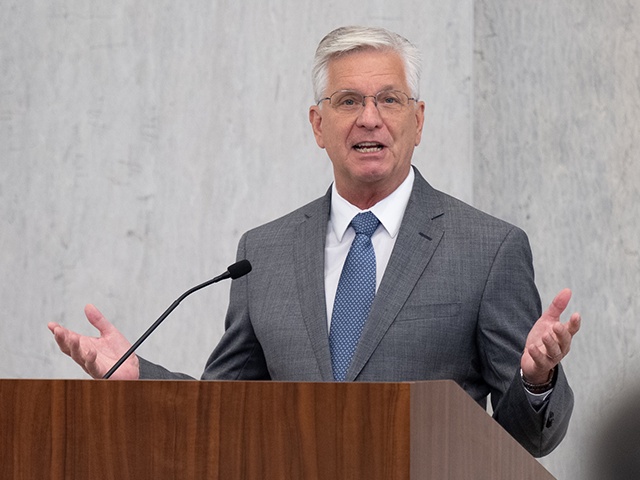

- Waller said tariff-driven price increases are likely one-off boosts that will not unsettle long-term inflation expectations.

- He outlined a 10% “smaller-tariff” scenario and a 25% “large-tariff” scenario and said cuts depend on progress toward the Fed’s 2% inflation target and a solid labor market.

- US and South Korea aim to finalize a trade package by July 8, with South Korean exports to the US down 8.1% in May following new tariffs.

- The Bank of Korea cut its key interest rate by 25 basis points last week to support growth after exports declined.