Overview

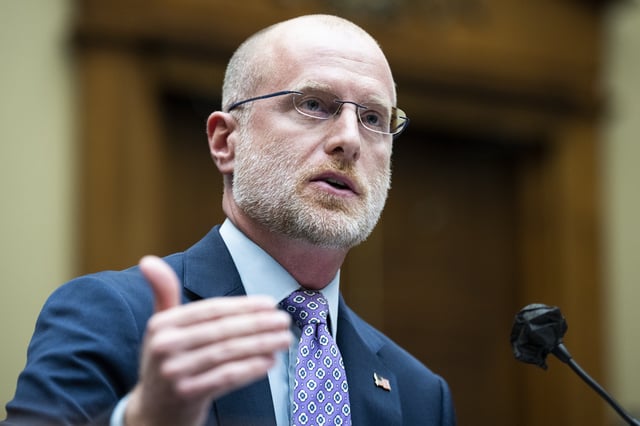

- FCC Chair Brendan Carr has stated that companies promoting 'invidious' DEI policies may face obstacles in gaining approval for mergers and acquisitions.

- Major deals under review include Paramount's $8 billion merger with Skydance Media and Verizon's $9.6 billion acquisition of Frontier Communications.

- Paramount has already scaled back its DEI initiatives, such as representation goals, following regulatory scrutiny.

- Democratic lawmakers have criticized the FCC's actions as politically motivated and a potential threat to First Amendment protections.

- The FCC is also investigating media companies and China-based firms for potential regulatory violations, broadening its scope beyond DEI policies.