Overview

- The products will let users take simple yes or no positions for as little as $1 on benchmarks including the S&P 500, Nasdaq-100, oil and gas, gold, cryptocurrencies, GDP and CPI, with launches expected later this year.

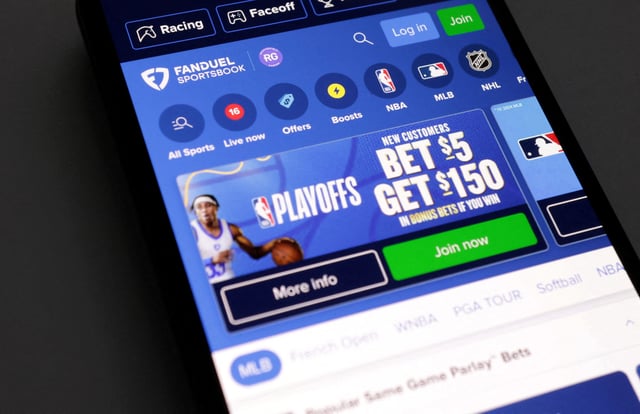

- CME and FanDuel will operate as a non-clearing futures commission merchant, with contracts listed on CME exchanges and financial terms not disclosed.

- FanDuel’s offering will focus on non-sports financial event contracts at launch, with those contracts overseen by the CFTC while FanDuel’s sportsbook remains regulated state by state.

- The move comes as prediction markets gain traction, with recent expansions by Robinhood and ongoing legal friction involving platforms like Kalshi and state gaming regulators.

- Flutter’s experience running Betfair was cited as relevant background, and industry analysts suggest the structure could allow sports contracts in the future, though none are planned now.