Overview

- The EBA and ECB stress tests assessed 64 major banks representing 75% of EU sector assets under a severe global downturn scenario driven by tariffs, geopolitical tensions and wars.

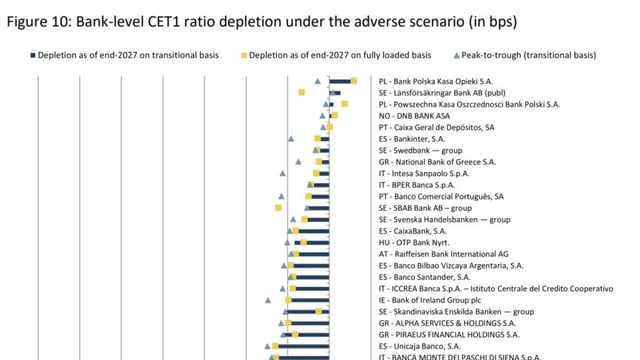

- EU banks as a whole would incur €547 billion in losses and see their CET1 ratios fall by 370 basis points to 12.1% by end-2027 while remaining capital-adequate.

- Italian lenders would face the smallest capital erosion of under 150 basis points compared with nearly 400 for French and German peers, led by Iccrea, Monte dei Paschi and BPER among top performers.

- Under CRR3 transitional rules, Italian banks’ CET1 ratios average 13.9% by 2027, dropping to 13.4% under full Basel III implementation.

- The ECB intends to adjust capital buffers based on the stress tests and is expected to cap dividend payouts at 17 banks to preserve resilience.