Overview

- The national survey reports that 76.5% of people aged 18–70 lack any insurance, leaving about 19.81 million with at least one policy.

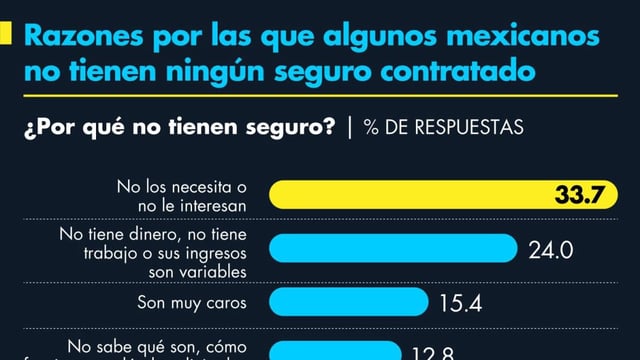

- Among those who have never been insured, 33.7% say they do not need it and 24% cite insufficient resources, unemployment or variable income; past users often canceled after bad experiences, job changes or viewing policies as too costly and underused.

- Women are less likely to be covered, with 80.9% uninsured compared with 71.3% of men.

- Among insured individuals, life coverage is most common (60.8%), followed by auto (50.1%), medical expenses (32.7%), personal accident (12.1%) and home (8.3%).

- Insurance penetration equals about 2.7% of GDP versus roughly 6% in Latin America and around 9% in the OECD, spurring calls for customer‑centric digitalization and stronger financial education.