Overview

- The ECB will keep its deposit rate at 2% at the July 24 meeting, deferring any cuts until after its seven-week summer recess.

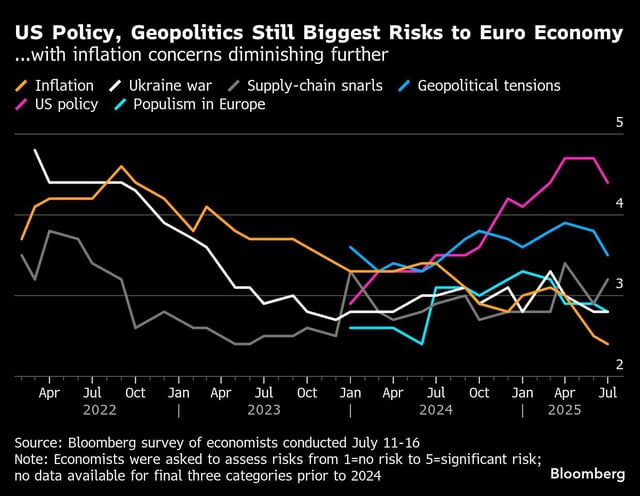

- Officials will follow a meeting-by-meeting approach to evaluate the potential effects of threatened 30% US tariffs before adjusting policy.

- A stronger euro is dampening inflationary pressure and squeezing exporters, exacerbating concerns over the economic outlook.

- Upcoming data on bank lending, consumer confidence and purchasing managers indexes will shape decisions on September rate moves.

- Bloomberg Economics projects two additional quarter-point cuts this year for peer central banks in the UK and Canada, while the Fed is seen holding rates until late 2025.