Overview

- Electronic Arts agreed to be acquired in an all-cash deal valuing it at about $55 billion by Saudi Arabia’s Public Investment Fund, Silver Lake, and Affinity Partners, with investors to receive $210 per share.

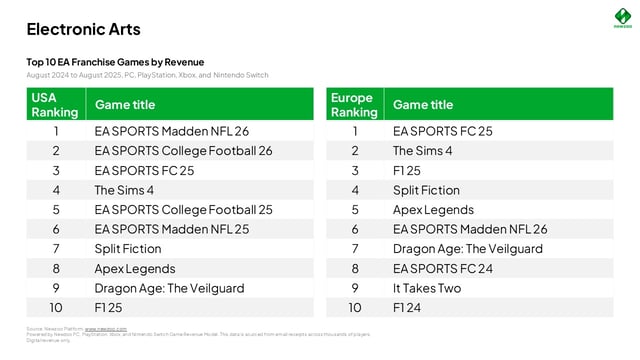

- Reports indicate the leveraged buyout will leave EA with roughly $20 billion in debt, which analysts say will steer priorities toward cash-generating sports and live-service franchises.

- Commentary predicts heavier reliance on microtransactions, battle passes, and time-limited in-game storefronts, with some expecting a push into mobile using ties to Scopely and Niantic.

- Industry experts warn the debt load could trigger layoffs, studio closures, or selective IP sales, though others argue private ownership could create room for longer-term creative bets.

- CNBC notes a 45-day period for alternative bids and says analysts view closing as likely pending approvals, with several calling the payout a strong outcome for current shareholders.