Overview

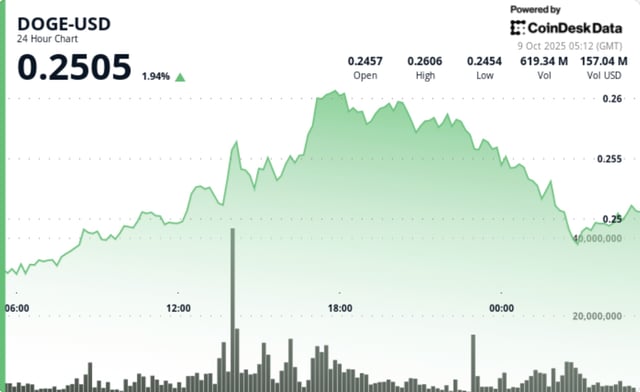

- DOGE hit an intraday high near $0.2609 before slipping to the $0.24–$0.25 area, with hourly charts showing it under $0.2550 and the 100‑hour SMA.

- Derivatives interest increased, with open interest up 2.3% to $4.44 billion and most top Binance traders positioned for upside, according to Coinglass and exchange data.

- Chart signals cited across reports include price holding above key moving averages, a 21‑day SMA over the 50‑day, an ascending‑triangle setup, and a monthly RSI bullish cross.

- Analysts highlight $0.27–$0.28 as pivotal resistance, with proposed targets near $0.31–$0.36 if cleared; additional levels flagged include $0.2744, $0.2884, and $0.3068.

- Risk markers include supports at roughly $0.2470, $0.2420, and $0.2350, while speculative narratives point to potential ETF approvals and rising DOGE dominance, plus outlier calls up to $2.28 that remain unconfirmed projections.