Overview

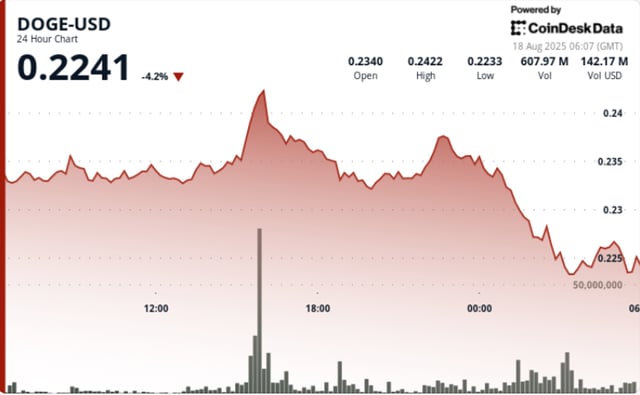

- Dogecoin slipped below its $0.23 support level on Aug. 17–18 after late-session selling erased earlier gains and exposed the token to potential falls toward key supports near $0.22 and $0.20.

- Large holders have added roughly 2 billion DOGE in the past week, raising whale-controlled supply to about 27.6 billion tokens (18% of total) and prompting a 900 million DOGE transfer linked to Binance that analysts warn may reflect internal flows.

- Futures open interest has exceeded $3 billion and daily placements have hit nearly 14.4 billion DOGE, with some data even tracking more than $10 billion in total exposure, heightening the risk of forced liquidations if momentum reverses.

- Bullish technical indicators, including a recent golden cross on the moving averages and a bullish flag pattern, underpin targets at $0.27–$0.36 and longer-term scenarios that stretch toward $0.70 if resistance breaks.

- Security concerns following a proposed 51% attack vote by a blockchain community and broader crypto market liquidations add to the downside risk, making support tests at $0.22 and $0.20 critical for DOGE’s next directional move.