Overview

- The national debt has climbed past $36 trillion and the House’s ‘One Big Beautiful Bill Act’ is projected to add about $2.5 trillion more over the next decade.

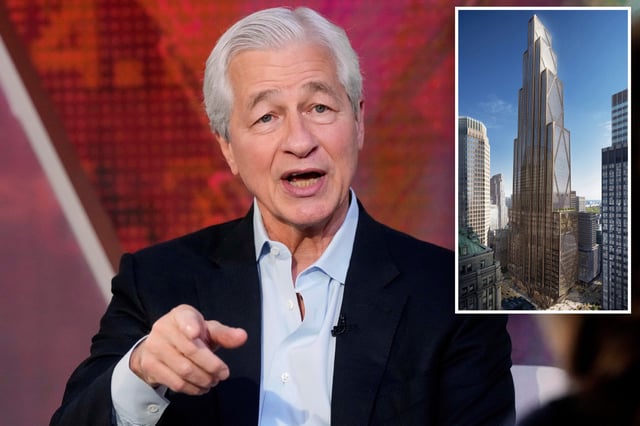

- Jamie Dimon cautions that this mounting debt could trigger a ‘crack’ in the bond market within six months to six years, widening credit spreads and raising borrowing costs for small businesses and consumers.

- Treasury Secretary Scott Bessent rejects Dimon’s forecast, arguing that tariff revenues and spending measures will drive deficits down by 2028.

- Moody’s downgraded the US credit rating last month over elevated debt and interest-payment ratios, and analysts warn that Section 899 of the pending bill could prompt capital outflows by taxing foreign investors.

- Dimon calls for pro-growth reforms—including deregulation, permitting overhaul and improved workforce training—to contain deficits and shore up bond-market stability.