Overview

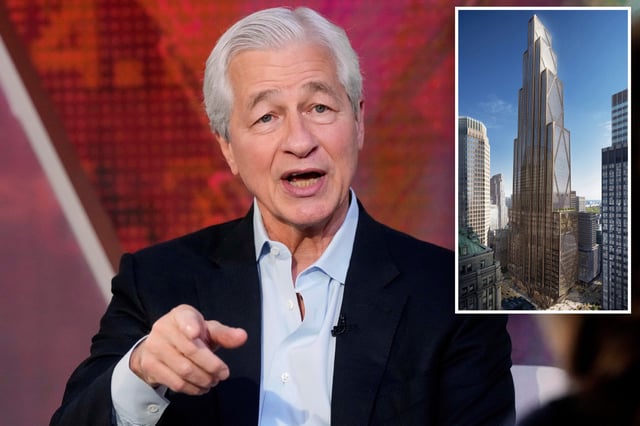

- JPMorgan CEO Jamie Dimon told the Reagan Forum and Fox Business that excessive pandemic spending and soaring debt could spark a “crack” in the bond market within six months to six years.

- Treasury Secretary Scott Bessent told CBS’s Face the Nation that Dimon’s track record of unmet predictions undercuts his warnings and projected gradual deficit reduction leading to a stronger fiscal position by 2028.

- The US national debt has climbed past $36 trillion, pushing the debt-to-GDP ratio above 124%, while the House-passed “One Big Beautiful Bill” is estimated to add $2.5 trillion to deficits over the next decade.

- Moody’s downgraded the US credit rating to Aa1 last month and 30-year Treasury yields recently topped 5%, signaling growing investor unease over fiscal stability.

- Dimon urged pro-growth measures—deregulation, permitting reform, skills training and targeted spending reforms—to restore confidence and avert broader market volatility.